The Obama administration just issued new guidelines to folks in the weed business; perhaps he should issue some guidelines to a few other businesses while he’s at it….

About the Author

Michael is a journalist and filmmaker. His award-winning documentary, Sleeping with Siri is playing film festivals across the country. Stusser runs TechTimeout campaigns in high schools across the country, asking teenagers to give up their digital devices (for a little while) in order to find balance, and perhaps even make eye-contact with their parents.You Might also like

-

Colorado Rockies

Fans attending Colorado Rockies games will be able to purchase items chock-full of marijuana at concessions stands this season! While this story turned out to be a hoax, we here at Higher Ground felt the need to comment on it anyway. -

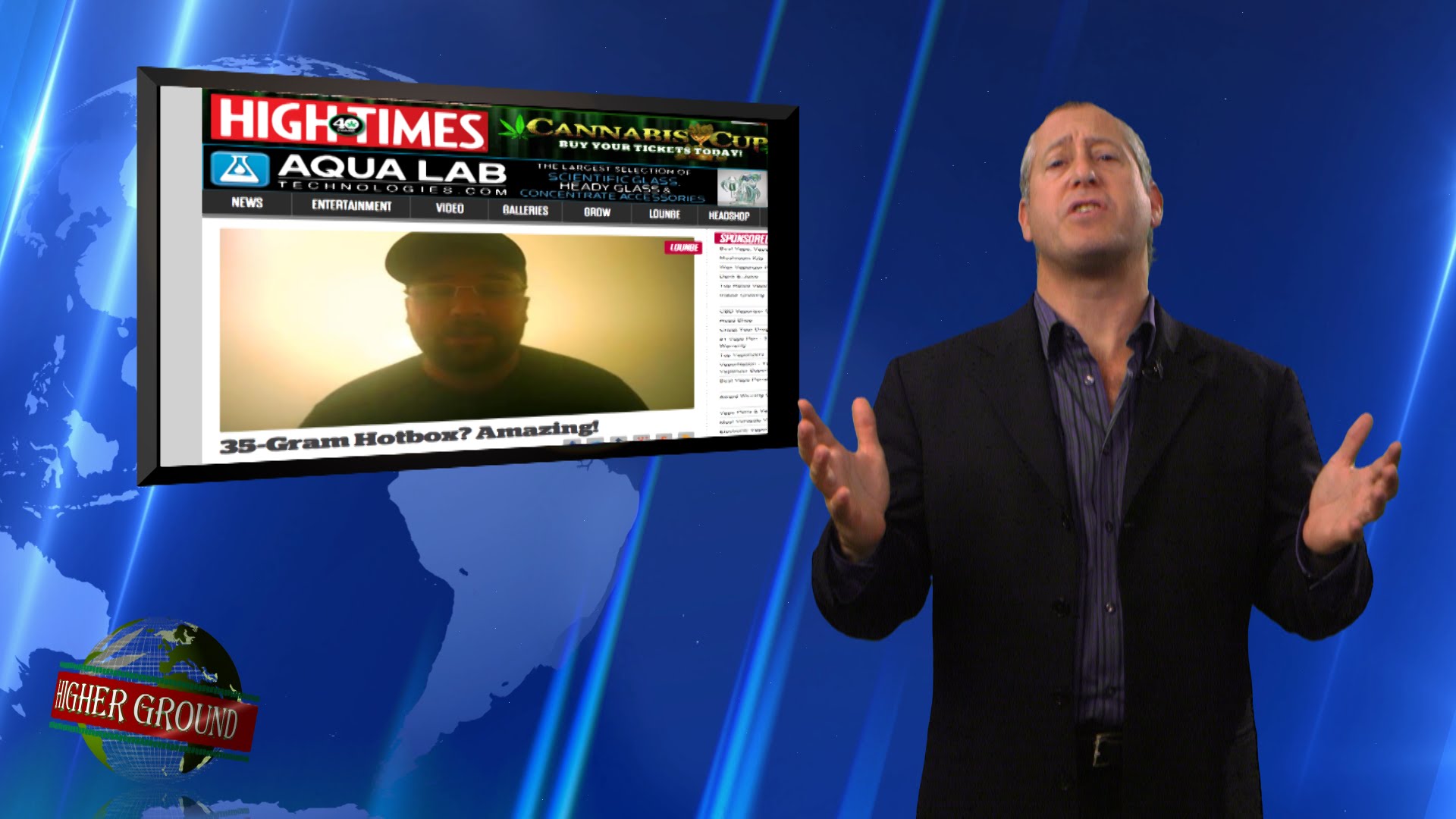

Marijuana.com Features Higher Ground Hot-Boxing Editorial

Our good friends at marijuana.com just highlighted our video on Hot Boxing. Thanks for the shout-out, we very much appreciate it!http://www.marijuana.com/news/2014/11/a-closer-look-at-hotboxing/

-

The Votes Are IN: Prohibition On the Way OUT

Alaska? YES! Oregon? YES! Washington DC? YES! Guam? YES? Higher Ground? YES!And while the referendum in Florida did not pass, let us give you some good news from the Sunshine State (where 58% of the voters supported medical marijuana initiative!). The issue brought out young voters, and they supported the measure big-time. Politicians from BOTH parties must now pay serious attention to States where marijuana is on the ballot, as young citizens will flood to the polls, and paying attention to geriatric politicians and other progressive causes as they vote on various important issues.

November brought a significant set of votes and victories. And once California joins the recreational realm in November of 2016 (after pioneering the medical dispensary vote in 1996), the catnip will be out of the bag. It’s a long ride, and looking up for the legalization movement.

For further analysis on the elections, votes on decriminalization, and future of legalization, here are the 5 fab articles on the subject.

http://www.cbsnews.com/news/2014-midterm-elections-marijuana-okd-in-alaska-oregon-washington-dc/

http://www.motherjones.com/mojo/2014/11/proposition-47-california-prisons-nonviolent

http://m.motherjones.com/politics/2014/11/map-united-states-legal-marijuana-2014-2016