We got our hands on a new cold-brewed coffee that’s infused with THC, and let’s just say, we’re flyin’ high!

You Might also like

-

IN LEGALIZING IT FOR THE MASSES, WE SEEMED TO HAVE SCREWED THE MEDICAL MARIJUANA PEEPS

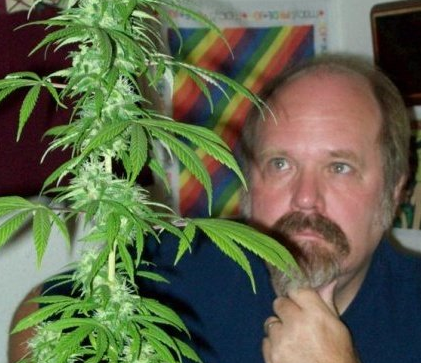

The lazy-ass staff at Higher Ground would like to thank Steve Elliot and the Seattle Weekly for their excellent coverage of the ongoing trials and tribulations regarding the legalization of marijuana in Washington State. Steve Elliott edits Toke Signals, tokesignals.com, an irreverent, independent blog of cannabis news, views, and information.

-

MARIJWHATNOW! THE SEATTLE POLICE DEPT. IS ALL GOOD WITH IT!

The Seattle Police Department not only has a blog, but they have a sense of humor about the recent legalization of weed.

-

Profiles in Legal Cannabis

Have you seen Higher Ground’s new series, “Profiles in Legal Cannabis?” Host Michael Stusser interviews the foremost thought-leaders in the legal cannabis profession, including ganjapreneurs, lawyers, farmers, graphic designers, recreational store owners, and medical pioneers. Watch now on MJ Channel One and MJ Headline News!

One comment on “Higher Ground: Coffee with Cannabis”

Comments are closed.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.