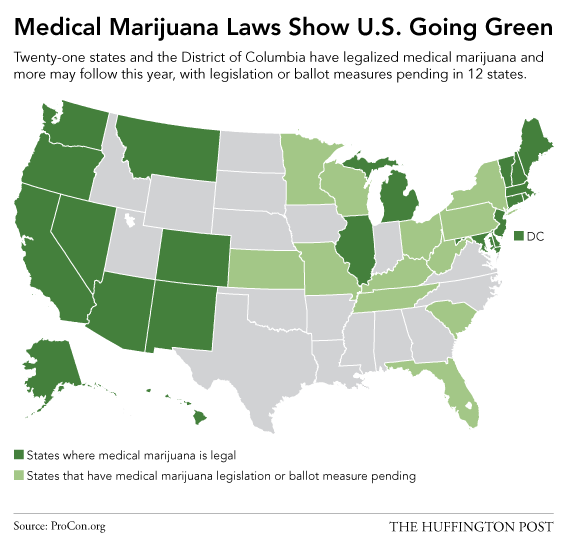

Alabama, Florida, Georgia, Indiana, Iowa, Kentucky, Minnesota, Mississippi, Missouri, North Carolina, Pennsylvania, South Carolina, Tennessee, Utah, Virginia and Wisconsin have all recently gone to pot. And that’s just the beginning….

About the Author

A Gonzo journalist hailing from New York City, Gonzo has contributed to pretty much every marijuana magazine and blog in the nation. He covers Medicinial, Growing and National News for Higher Ground. And since it’s not legal where he lives, he’ll remain anonymous. For now.You Might also like

-

I CAN SEE LEGALIZATION FROM HERE: ALASKA TO VOTE IN NOVEMBER

With the general election five months away, more Outside cash is making its way into the Alaska campaign to legalize marijuana.

The Marijuana Policy Project injected $140,000 into the Campaign to Regulate Marijuana Like Alcohol in Alaska at the end of May, according to filings with the Alaska Public Offices Commission. It marks the second largest donation the campaign has received this election season and pushes the contribution total for the campaign just over the half-million dollar mark.

Western Alaska leaders fret over marijuana legalization in rural communities

Supporters issue challenge to opposition in fight to legalize marijuana in Alaska

In comparison, the group opposing the measure, Big Marijuana. Big Mistake. Vote No on 2, has raised a mere $31,000 since organizing in April. Most of that money came from a single donation from the Chenega Corp., an Alaska Native village corporation based in Anchorage, which gave $25,000 to the campaign last month.

At stake is Ballot Measure 2, an initiative that would regulate and tax marijuana like alcohol in Alaska. If approved, the initiative would regulate the production, sale, and use of marijuana to adults 21 years of age and older and tax its commercial sale. Alaska would become the third state to legalize marijuana, behind Washington and Colorado. The initiative’s language is largely based on Colorado’s law.

Proponents say the measure is long in coming and that the “prohibition” on marijuana isn’t working. Opponents argue that it’s too much, too soon, and that Alaska doesn’t need to be the testing ground for marijuana legalization. Polls conducted earlier in the year put support for the initiative at around 50 percent.

The $140,000 doesn’t mark the biggest donation from the Marijuana Policy Project, a national group that works to advocate for marijuana legalization across the U.S. In March, the organization contributed $210,000 in cash to the Alaska campaign. It also sent one staff member, Chris Rempert, to serve as campaign director.

Pro-legalization campaign spokesman Taylor Bickford said the donation will be used to “continue educating Alaskans” about the benefits of legalizing marijuana here. He said it was not intended to serve as a response to the large donation from Chenega.

“We have our own strategy and our own plan that we will be executing between now and November,” he said.

Deborah Williams, spokeswoman with the Big Marijuana. Big Mistake. Vote No on 2 campaign, was not surprised to hear about the large donation Thursday, nor was she concerned, she said.

“We always anticipated we would be grossly outspent,” Williams said.

The anti-legalization campaign has focused on maintaining a grassroots presence, working more to start conversations and participate in forums that “get the truth of this initiative out” Williams said.

Williams noted that other Alaska political battles have proved that Alaskans don’t take well to Outside groups pushing agendas in Alaska.

“No matter how much money the Marijuana Policy Project and other Lower 48 entities put into this battle, they can’t eliminate those truths,” Williams said.

Bickford rejected the idea that the Marijuana Policy Project was pushing any sort of agenda. He said the group has been working to reform marijuana policy in Alaska for 20 years, and in that time has built meaningful connections in the state.

“Alaskans are going to focus on the issues. They’re not going to focus on distractions and fundraising,” he said.

What the campaign will look like from here remains to be seen. Bickford noted that with the U.S. Senate race dominating traditional advertising media right now, most campaigns are in the process of figuring out “how to deal with that.”

“All the campaigns are struggling with the limited air space due to the influx of money in the senate race,” Bickford said. “We plan on running a comprehensive campaign that connects with voters in various ways.”

(THANKS TO REPORTER SUZANNA CALDWELL and the Alaska Dispatch for this report.)

-

Washington State Update: Cannabis Public Media

July 8th, 2016 marked the one-year anniversary of retail cannabis sales in the state of Washington, and while the implementation of I 502 has been a success on many levels, a recent change in cannabis laws regarding medical marijuana enacted during the last legislative session have mandated many radical and unpopular changes to the nation’s second oldest medical marijuana program … for an update on cannabis in Washington state CPM’s Brian Bahouth spoke with Michael Stusser, Seattle Weekly columnist and host of Higher Ground TV … listen to this mix of words and music …

-

Here’s the Weed Law In Every Damn Legal State

Alaska

Law: Measure 2 (52.15%)

Year Passed: 2014

Date Implemented: February 24th, 2015

Age Requirement: 21

Administrative Agency: Marijuana Control Board

Tax Structure: $50 per ounce on all marijuana sold by wholesale cultivation facilities, additional local taxes expected

Recreational Outlets: No, expected to open Spring 2016

Possession Limit: 1 oz, and all marijuana from a grow, at the location of that grow

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 1 oz.Colorado

Law: Amendment 64 (55.3%)

Year Passed: 2012

Date Implemented: January 1st, 2014

Age Requirement: 21

Administrative Agency: Department of Revenue, Marijuana Enforcement Division (MED)

Tax Structure: 15% on grower, 10% special sales tax, 2.9% standard sales tax, additional local taxes may apply

Recreational Retail Outlets: Yes

Possession Limit: 1 oz, non-residents of Colorado 0.25 oz

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 1 oz, open container law appliesOregon

Law: Measure 91 (56.1%)

Year Passed: 2014

Date Implemented: July 1st, 2015

Age Requirement: 21

Administrative Agency: Oregon Liquor Control Commission

Tax Structure: 17% sales tax

Recreational Retail Outlets: MMJ dispensaries to begin selling recreational October 2015 via Senate Bill 460. Possession Limit: 8 oz at home, 1 oz outside, 1 lb solid edibles, 72 oz liquid, 1 oz extract (concentrates)

Home Cultivation: 4 plants

Transport: 1 oz within state lines, Non-flowering plantsWashington

Law: Initiative 502 (55.7%)

Year Passed: 2012

Date Implemented: July 8th, 2014

Age Requirement: 21

Administrative Agency: Washington State Liquor Control Board

Tax Structure: 25% at all stages, grower, processer, retailer and customer, plus normal sales taxes

Recreational Retail Outlets: Yes

Possession Limit: 1 oz marijuana, 16 oz of marijuana-infused products in edible form, and 72 oz of marijuana products in liquid form

Home Cultivation: No

Transport: 1 ozWashington D.C. (formally District of Columbia)

Law: Initiative 71 (64.8%)

Year Passed: 2014

Date Implemented: February 26, 2015

Age Requirement: 21

Administrative Agency: None

Tax Structure: None, retail & sale is still illegal

Recreational Retail Outlets: No

Possession Limit: 2 oz

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 2 oz

Alaska

Law: Measure 2 (52.15%)

Year Passed: 2014

Date Implemented: February 24th, 2015

Age Requirement: 21

Administrative Agency: Marijuana Control Board

Tax Structure: $50 per ounce on all marijuana sold by wholesale cultivation facilities, additional local taxes expected

Recreational Outlets: No, expected to open Spring 2016

Possession Limit: 1 oz, and all marijuana from a grow, at the location of that grow

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 1 oz.Colorado

Law: Amendment 64 (55.3%)

Year Passed: 2012

Date Implemented: January 1st, 2014

Age Requirement: 21

Administrative Agency: Department of Revenue, Marijuana Enforcement Division (MED)

Tax Structure: 15% on grower, 10% special sales tax, 2.9% standard sales tax, additional local taxes may apply

Recreational Retail Outlets: Yes

Possession Limit: 1 oz, non-residents of Colorado 0.25 oz

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 1 oz, open container law appliesOregon

Law: Measure 91 (56.1%)

Year Passed: 2014

Date Implemented: July 1st, 2015

Age Requirement: 21

Administrative Agency: Oregon Liquor Control Commission

Tax Structure: 17% sales tax

Recreational Retail Outlets: No; Still illegal to buy or sell. Outlets expected 2016 – MMJ dispensaries may begin selling recreational October 2015 if Senate Bill 460 is signed into law.

Possession Limit: 8 oz at home, 1 oz outside, 1 lb solid edibles, 72 oz liquid, 1 oz extract (concentrates)

Home Cultivation: 4 plants

Transport: 1 oz within state lines, Non-flowering plantsWashington

Law: Initiative 502 (55.7%)

Year Passed: 2012

Date Implemented: July 8th, 2014

Age Requirement: 21

Administrative Agency: Washington State Liquor Control Board

Tax Structure: 25% at all stages, grower, processer, retailer and customer, plus normal sales taxes

Recreational Retail Outlets: Yes

Possession Limit: 1 oz marijuana, 16 oz of marijuana-infused products in edible form, and 72 oz of marijuana products in liquid form

Home Cultivation: No

Transport: 1 ozWashington D.C. (formally District of Columbia)

Law: Initiative 71 (64.8%)

Year Passed: 2014

Date Implemented: February 26, 2015

Age Requirement: 21

Administrative Agency: None

Tax Structure: None, retail & sale is still illegal

Recreational Retail Outlets: No

Possession Limit: 2 oz

Home Cultivation: 6 plants, with only 3 in flowering stage at a time

Transport: 2 ozThanks to Smoker’s Guide for their in-depth research.